A consortium of crypto investors pulled together $47 million worth of ether in a week to try to buy a rare, first-edition copy of the U.S. Constitution at a Sotheby’s auction — and lost. What happens to all that cash is up to the people.

The group, known as ConstitutionDAO, wrote in its ‘frequently asked questions’ that the funds would be redeemable, minus a transaction fee.

ConstitutionDAO contributor Alice Ma confirmed to CNBC that they would “for sure…provide everyone an option for a refund.” Ma went on to say that “there are many people who have already said they want to leave their funds in the wallet, and we are deciding between several options internally for that scenario!”

On a Twitter Spaces following the lost bid, it was unclear where exactly the money would go next. Some members of the DAO shared plans to potentially purpose the funds toward future auctions.

Member Liz Yang, chiming in from on board an American Airlines plane, said that she hoped to put the money to good use. “I feel like we set the bar so high,” said Yang. “We need to do something equally as epic, whether it’s a future auction, but that’s for the people to decide.”

In theory, next steps will be determined by the “decentralized autonomous organization” that facilitated the fundraise. You can think of a DAO like a group of individuals acting in concert with no single leader. Unlike a normal pool of investors, DAOs rely on cryptocurrency technology to track and validate participation in the group, as well as to facilitate the inner-workings of how to raise and distribute large amounts of cash.

ConstitutionDAO’s rallying call was “WAGBI” or “we’re all gonna buy it.” But in fact, the thousands of investors who comprise this DAO would not have received fractional ownership of the document. Instead, they would have become holders of a crypto token known as “People” that would have granted them certain voting rights over the future of the document.

“Everyone who buys in, they get a portion of the governance token of the DAO, and they can then use that token to vote on where the Constitution should actually be custodied,” Ma told CNBC prior to the auction. The crypto contingent had been weighing different museums and libraries across the country, including the Smithsonian and the New York Public Library.

Many wondered why organizers stopped short of making the winning offer in a heated bidding war that gaveled at $41 million.

One organizer in the group’s Discord server said that they stopped the bidding where they did because there wouldn’t have been enough money left over to account for the “proper care and maintenance” required for custody of the Constitution.

How it all began

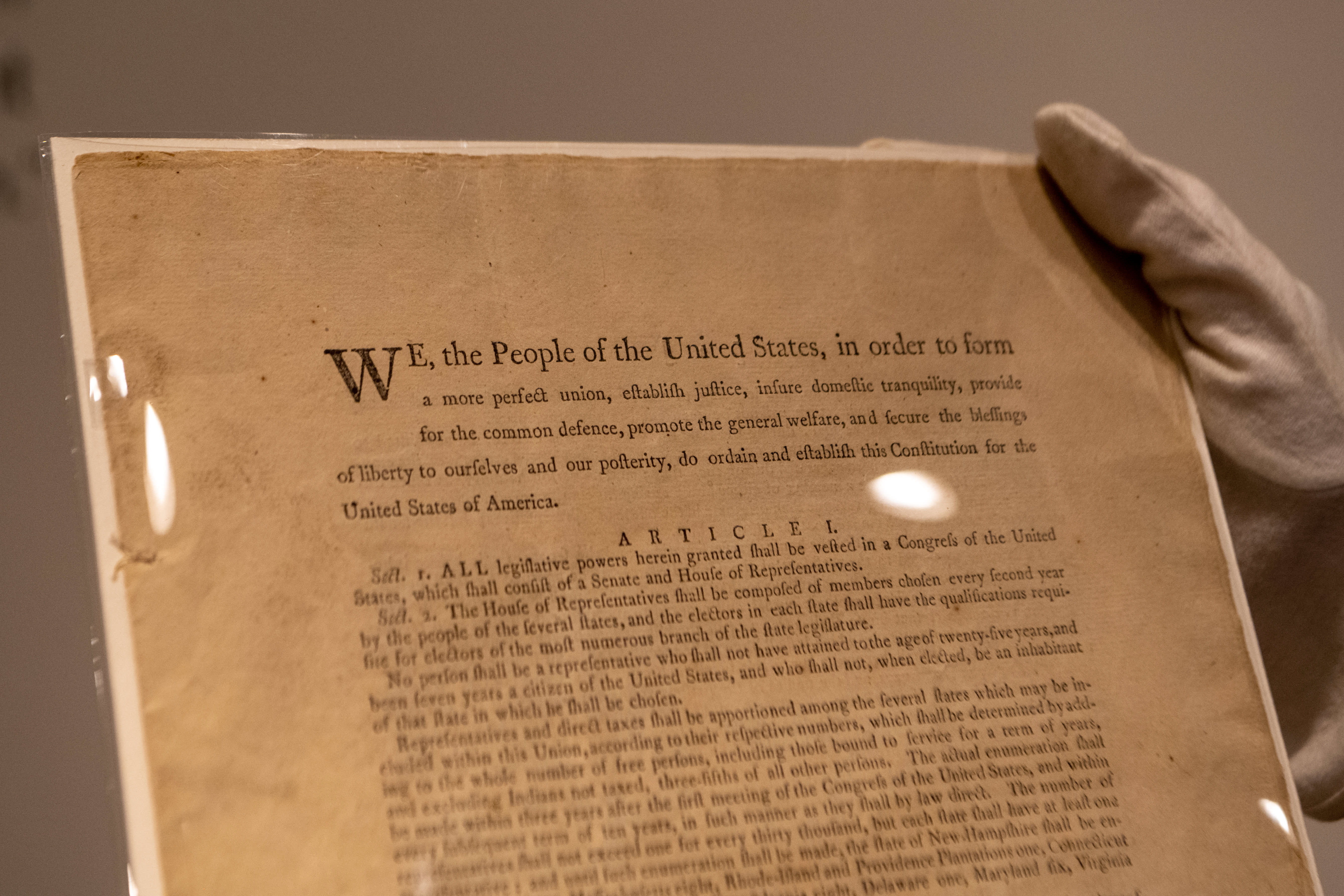

The idea started up a week ago thanks to an exchange of semi-joking Twitter messages about making a bid on the 1787 first-edition printing. It is the first time in 33 years that one of the thirteen surviving copies of the historic document has been up on the auction block. The copy was previously owned by New York philanthropist Dorothy Tapper Goldman.

The idea to pool ether from thousands of crypto investors in order to make a group bid on a historic artifact was an instant hit.

After five days, the DAO had collected more than $4 million. One week on, and the crypto-clan had pooled over $47 million worth of ether, ahead of the auction.

While the ConstitutionDAO coffers swelled with ether, organizers were performing logistical acrobatics to find a legal path to make a legit bid.

DAOs don’t rely on banks to store their cash but are instead governed by smart contracts. These contracts are self-executing agreements that live on the blockchain, which is the name for the digital ledger that underpins cryptocurrencies. DAOs also lack a central governing authority and are led by decisions determined by votes made by its collective membership. The organizational structure runs contrary to many of the eligible bidder stipulations detailed by Sotheby’s.

According to the group’s FAQ, Sotheby’s does not allow DAOs to bid directly, nor did the auction house accept anything other than government-issued currencies for this lot, although it accepted the cryptocurrency ether for the first time ever for two works by renowned street artist Banksy earlier in the evening. Know-your-customer compliance is also required, which is hard for a collective comprised of thousands of investors.

To meet the criteria, ConstitutionDAO teamed up with a crypto exchange to convert its ether to dollars, as well as a non-profit that actually made bids on the DAO’s behalf. The group also formed a corporation to help facilitate the transfer.

This created a complicated and not entirely clear chain of ownership.

Regardless, the idea of DAOs is gaining traction because its speed and decentralized nature, according to Auston Bunsen, co-founder of QuikNode, which provides blockchain infrastructure to developers and companies. Think random strangers coordinating to buy a basketball team, Bunsen told CNBC.

“They represent a new kind of organization moving at hyper speed,” said Bunsen.

ConstitutionDAO joins a long list of DAOs pooling funds to buy real-world assets. In July, PleasrDAO bought a copy of the Wu-Tang Clan album once owned by Martin Shkreli.

This article was originally published on CNBC