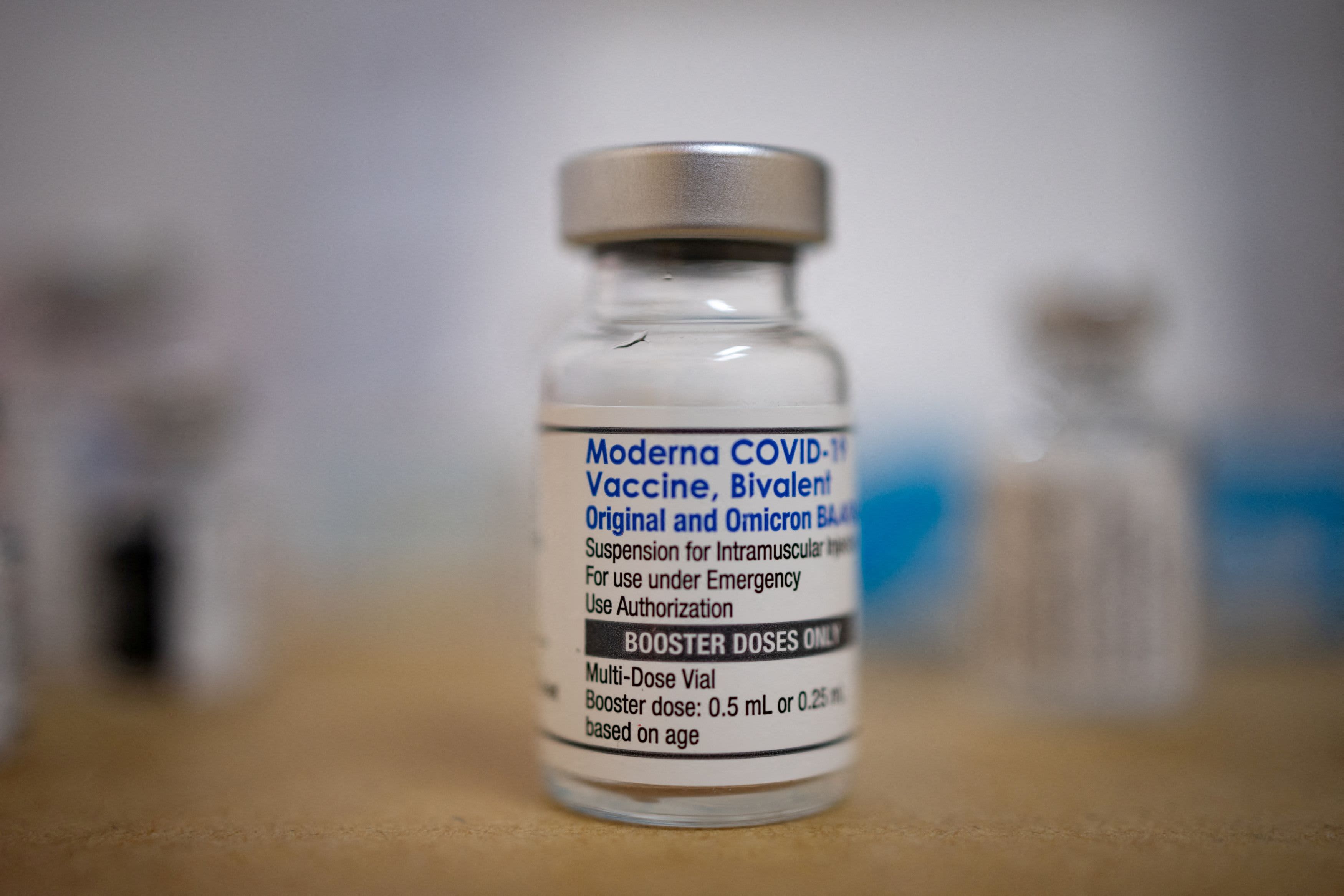

Moderna on Thursday missed earnings expectations for the fourth quarter, as costs rose from surplus production capacity and lower demand for its Covid-19 vaccine, the company’s only product on the market.

Moderna reported quarterly earnings of $3.61 per share, a 68% decrease from the same period in 2021 when it booked $11.29 per share. The figure fell short of the $4.68 a share Wall Street expected.

The Boston biotech company generated $5.1 billion in revenue in the fourth quarter of 2022, which was in line with analyst expectations but a 30% drop from the same period in 2021.

Moderna shares fell as much as 4% in Thursday morning trading.

Moderna has signed contracts for $5 billion in Covid vaccine deliveries for 2023. The company expects additional sales this year in the U.S., Europe and Japan, but demand for the shots is falling as the pandemic eases and vaccination shifts to an annual schedule rather than repeated boosting.

The U.S. government also plans to stop buying shots for the public as soon as this summer, shifting procurement and distribution to the private market. Moderna estimates U.S. market volume in fall 2023 will be 100 million doses, said Arpa Garay, the company’s chief commercial officer.

Garay wouldn’t provide projections on Moderna’s share of the fall 2023 U.S. market. She said the company is in discussions with customers for fall contracts.

Here’s how the company performed compared with what Wall Street expected, based on analysts’ average estimates compiled by Refinitiv:

- Adjusted earnings: $3.61 per share, vs. $4.68 expected

- Revenue: $5.1 billion, vs. $5 billion expected

Moderna sold $18.4 billion in vaccines during 2022, a 4% increase over the previous year and the company’s high-water mark for revenue during the pandemic. The company booked net income of $8.4 billion in 2022, a 31% decrease over 2021.

The company said its costs increased 25% in the fourth quarter. These expenses included a $297 million write-off for vaccines that have exceeded their shelf life, $376 million from unused manufacturing capacity and a $400 million royalty payment to the National Institute of Allergy and Infectious Diseases.

Though the Covid shot remains Moderna’s only product on the market, the company plans to ask the Food and Drug Administration in the first half of this year to approve its vaccine that protects older adults from respiratory syncytial virus after reporting positive data from a clinical trial. Moderna expects FDA approval in late 2023 or early 2024.

Garay said Moderna will leverage the infrastructure it already has in place for Covid to launch the RSV vaccine. She wouldn’t provide details on how much Moderna will charge for the RSV shot but said the company will ensure patients can access the vaccine regardless of their ability to pay for it.

The company has another potential commercial product in the works. Last week, Moderna said its flu vaccine candidate met the goal for immune response against influenza A, the most common type, in its study but missed against influenza B. Independent data monitors will review the first efficacy results for the vaccine in the first quarter of this year, the company said.

“If we do see efficacy, that is the gold standard for proceeding with regulatory filing and full approval,” Dr. Stephen Hoge, Moderna’s president and head of research, said Thursday. “If we do not yet meet that threshold, then we’ll be looking forward to subsequent interim analyses in that study.”

The FDA has also designated Moderna and Merck’s personalized cancer vaccine as a breakthrough therapy, which could expedite development and regulatory review of the shot.

This article was originally published on CNBC