A man check his phone near an Apple logo outside its store in Shanghai, China September 13, 2023.

Aly Song | Reuters

Apple is facing a number of issues in China, with geopolitical risks mounting and the economy still not firing as many would have hoped.

But the biggest challenge of all, according to analysts, could be a resurgent Huawei after a purported major semiconductor breakthrough that flew in the face of U.S. sanctions.

The latest chip, made by China’s biggest semiconductor manufacturer SMIC, has sparked concern in Washington and raised questions about how it was possible, without the company being able to access critical technologies.

But there is also scrutiny on whether the process being used to make these new chips is efficient enough on a large scale to sustain a Huawei comeback.

What has happened to Huawei so far?

What’s the big deal about Huawei’s new chip?

Alongside Apple and Samsung, Huawei is one of only a few companies that has designed its own smartphone processor. This was done through the Chinese firm’s HiSilicon division.

The chip however was manufactured by Taiwan Semiconductor Manufacturing Co., or TSMC. U.S. export restrictions, which effectively barred Huawei from using American technology anywhere along the chipmaking process, meant the Chinese company could no longer source its chips from TSMC.

The Taiwanese chipmaker is the most advanced semiconductor manufacturer in the world. There is no Chinese company that can do what TSMC does. That’s why shockwaves were sent through the political and tech world when Huawei quietly released the Mate 60 Pro in China this month, with analysis showing a chip inside made by SMIC.

Along with Huawei, SMIC is on a U.S. trade blacklist called the Entity List. Companies on this list are restricted from buying American technology. Meanwhile, SMIC’s technology is seen as generations behinds the likes of TSMC.

So how could this have been done with the huge amount of sanctions on both Huawei and SMIC?

What we know about Huawei’s chip

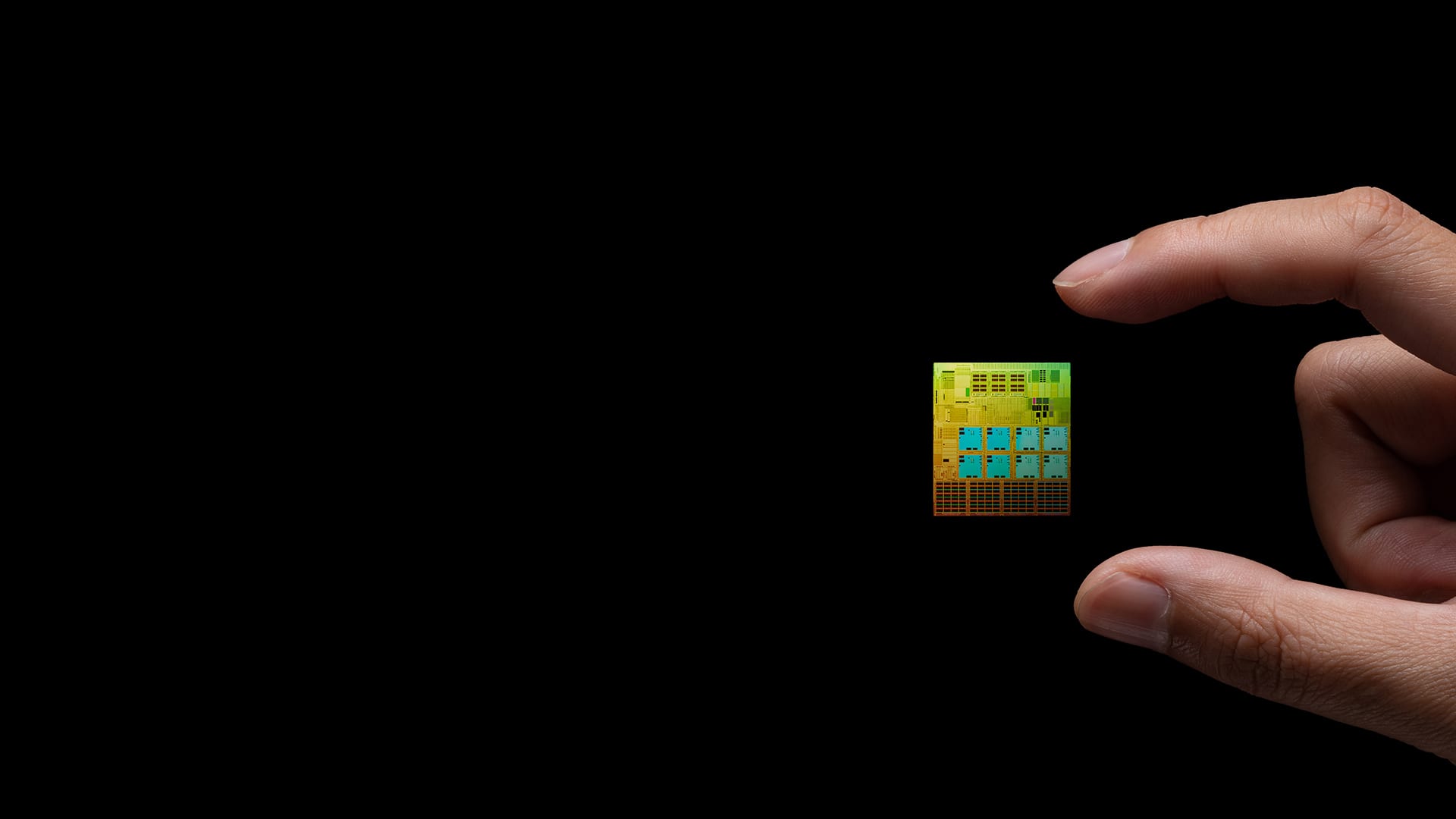

Huawei’s smartphone chip is called the Kirin 9000S, which combines the processor and components for what appears to be 5G connectivity. 5G refers to next-generation mobile internet that promises super-fast speeds. Huawei has not confirmed the phone is 5G capable, but reviews have shown the device is capable of hitting download speeds associated with 5G.

The semiconductor has been manufactured using a 7 nanometer process by SMIC, China’s biggest contract chipmaker, according to an analysis of the Mate 60 Pro by software company TechInsights.

The nanometer figure refers to the size of each individual transistor on a chip. The smaller the transistor, the more of them can be packed onto a single semiconductor. Typically, a reduction in nanometer size can yield more powerful and efficient chips.

The 7nm process is seen as highly-advanced in the world of semiconductors, even though it is not the latest technology.

For years, SMIC struggled to make 7nm chips. That’s in part because it couldn’t get its hands on a very expensive piece of kit called an extreme ultraviolet (EUV) lithography machine. These are made by Dutch firm ASML, but the company has been restricted by its government from sending these machines to China.

Many thought this would hold back SMIC’s ability to make advanced chips. But it seems to have made it happen without these tools.

In a blogpost this month, Dan Hutcheson, vice chair of TechInsights, said the 7nm chip “demonstrates the technical progress China’s semiconductor industry has been able to make without EUV lithography tools.”

Huawei was not immediately available for comment regarding this story when contacted by CNBC.

Is this a big deal or just posturing?

From a technology perspective, it is significant that SMIC has manufactured chips using a 7nm process without ASML’s EUV machines.

Pranay Kotasthane, deputy director of the Takshashila Institution, told CNBC that it is likely that equipment used for older manufacturing processes are being “repurposed” for these more advanced chips. But he believes the process is likely being undertaken with “lower efficiency” than if SMIC were to use cutting-edge equipment.

And that’s a key point. While SMIC is able to create 7nm chips, it’s unclear how efficient, profitable and sustainable that is on a bigger scale. A closely watched metric is “yield” — the number of chips made out of a specific wafer.

If a chip manufacturer’s yield is low, then the process is not seen as efficient and can be costly. While the yield of SMIC’s 7nm process for Huawei chips is not known, it is “probably low,” Kotasthane said.

It is a waiting game to see if SMIC can produce the number of chips that Huawei requires at a profitable scale.

What will the U.S. do next?

The technology advancement has certainly rattled Washington. The U.S. Department of Commerce issued a statement this month saying it is looking to get more information on Huawei’s chip.

SMIC’s 7nm manufacturing process has also exposed some of the weaknesses in the U.S.’s export restriction strategy, which could lead to further curbs.

“There will be pressure on the U.S. to reconsider its export controls strategy, which was based on the assumption that controls would prevent Chinese companies from producing advanced-edge chips, while the business-as-usual approach would continue at the trailing-edge nodes. It is increasingly becoming clear that this distinction doesn’t work in reality,” Kotasthane said.

He added that Washington may look at other areas of the chip design and manufacturing process to enact further restrictions.

Apple’s China headwinds grow with Huawei chip

The Wall Street Journal reported this month that Chinese central government staffers had been banned from using iPhones and other foreign branded phones for work and even prohibited them from being brought into the office.

China’s Ministry of Foreign Affairs said last week there weren’t any regulations prohibiting the purchase and use of foreign phones.

As geopolitical tensions between the U.S. and China continue to bubble under the surface, it is perhaps a potential Huawei resurgence that poses the biggest threat to Apple.

“It’s expected that Huawei will pose a bigger challenge to Apple in China than the geopolitical issue,” Will Wong, a senior research manager at IDC, told CNBC.

“This is because Huawei not only has the same premium brand image as Apple but also is a national pride in China.”

Apple is seen as a high-end smartphone maker and Huawei had directly competed with the U.S. firm in China for years. But Huawei’s sales fell off a cliff when it couldn’t equip its smartphones with 5G technology and the latest chips.

Any kind of resurgence in this area, as appears to be the case with the Mate 60 Pro, could make Huawei’s new phones an attractive option again for Chinese buyers.

“The biggest threat from Huawei is its continuous development in technology, not only in chips but also in new form factors like foldables,” Wong added.

This article was originally published on CNBC